Last month we featured two powerful blog posts from CPA and credentialed reserve funding provider, David T. Schwindt. For those of you who read David’s insights on reserve funding and risk mitigation, I trust you found the information helpful!

In today’s post, I’ll recap the main takeaways from David’s content, as well as provide some added context for what his insights mean for how you manage property maintenance and repair.

Three Key Takeaways from Dave’s Posts…

1. A reserve study has two main components.

They are: (1.) the physical analysis and (2.) the funding (financial) analysis.

The physical analysis is the foundation of the funding analysis, and its accuracy dictates whether the money stored in your reserve funds is an appropriate (or wasteful) amount.

The bottom line: Proper physical analysis of property is a specialized professional discipline, involving a robust approach and industry standards for assessing the condition of your building.

2. Reserve Funding Philosophies range from 0% to 100% contingency.

In his first blog post, David outlined three reserve funding models to illustrate the vast spectrum of funding philosophies:

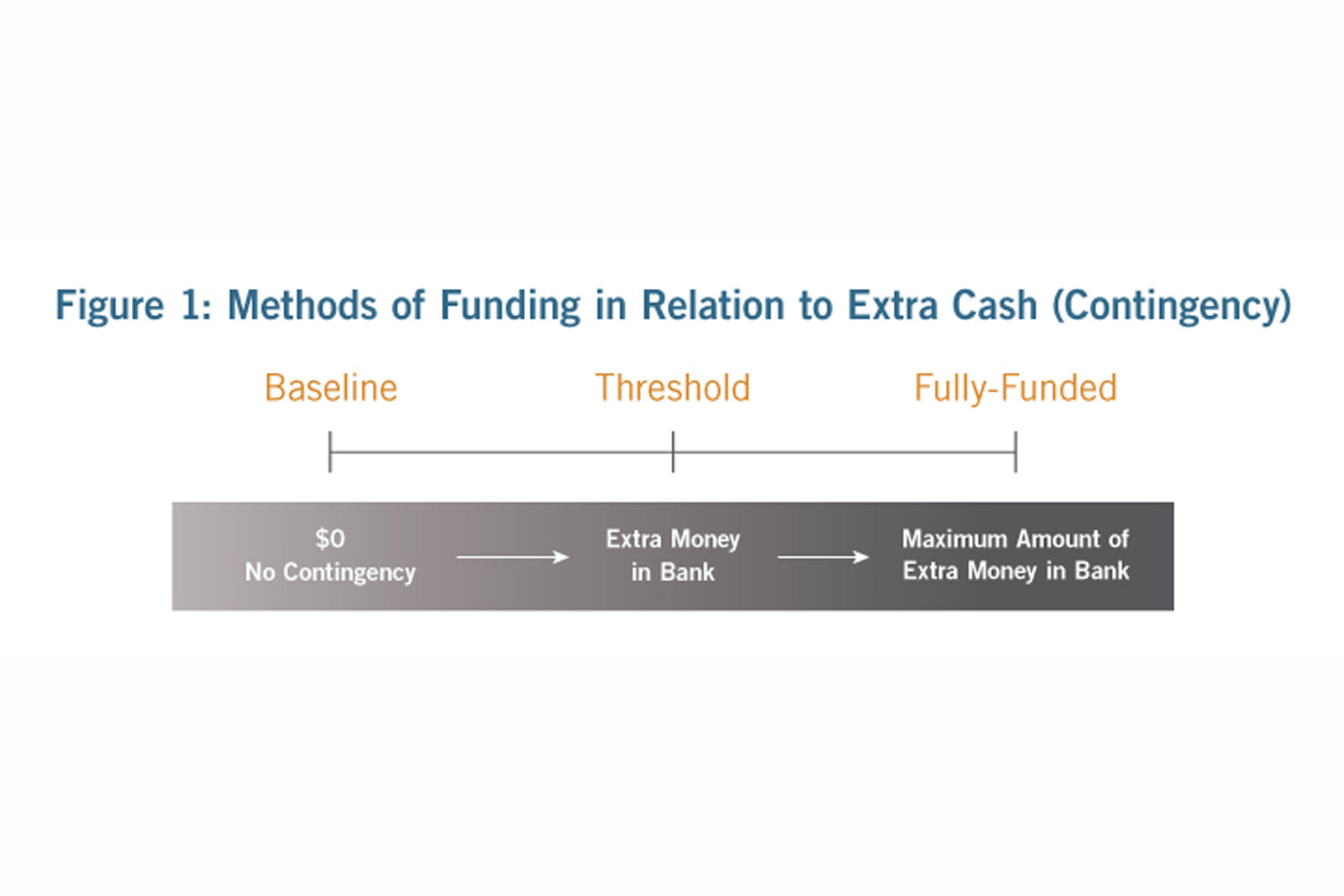

Baseline Funding – funds only expected costs, and does not account for any contingency funding to cover surprises along the way.

Threshold Funding – funds all expected costs (like the baseline model) plus a threshold contingency amount to cover unexpected costs that arise.

Full Funding – allows funding for twice the amount of expected costs, providing a very large (100%) threshold contingency.

The bottom line: Greater energy, discipline, and professionalism in how you manage property maintenance and repair can reduce the risk of expensive surprises, allow for a lower contingency, and free up capital that would otherwise be tied up in reserve accounts.

3. Best practices can lower the risk of special assessment.

It’s common to hear risk of special assessment correlated with contingency amount:

“If I maintain a larger contingency, there’s less risk of dealing with a lack of funds and, therefore, lower potential for a special assessment.”

But, this correlative relationship leaves out the primary causal portion of the equation: risk of surprises. The greater the risk of surprises (i.e. unexpected costs), the higher the risk of a special assessment. This, in turn, stipulates a larger contingency in the reserve account (i.e. money out of your pocket) to mitigate against special assessment. As you can see, it’s a vicious cycle!

In his second blog post, David shared 7 best practices that increase the effectiveness of a property owner’s building management, mitigate risks associated with saving too little money, reduce the probability of surprises and lower the required contingency. You’ll see them in Figure 2, which shows each best practice correlated with a reduction in contingency funding.

David’s best practices for risk mitigation are fundamental steps in the management of any building project, especially one with communal ownership like a Homeowner’s Association.

The involvement of a specialized construction professional is essential for:

Properly evaluating your building elements (components), especially the weather resisting exterior envelope, in conformance with the highest standards (like ASTM E2018 and E2128);

Writing a maintenance plan and budget to help building elements last longer with fewer repairs, and structuring it in a way so you can compare your plan and budget to what really gets spent;

Performing ongoing inspections to catch issues before they become worse or cost more to repair, and structuring the information so you can track the performance of critical building elements over time;

Incorporating all building elements into the reserve study to account all future repairs;

Updating the reserve study periodically to account for increase in prices, changes in cash reserves, application of adjusted inflation;

Specifying maintenance and repair work professionally to ensure it will last as long as you expect it to, and getting better quality that will last longer, thereby decreasing the total cost of ownership (TCO), and putting those specifications out to bid so that you get the lowest price the market will bear;

Apply professional construction management discipline to protect your legal rights and manage the work, and, inspecting to verify the high quality work that was contracted for is being installed.

The bottom line: When properly executed, integrated, and delivered, these risk management best practices generate savings that far outweigh the cost of implementation.

Please note: This highly analytical approach to building lifecycle management does come with a price tag. So be prudent, and move forward in a way that is commensurate with the value of your property.

Three Deep Thoughts with Pete Fowler

Three common strategies for managing property maintenance and repair include hope, prayer, and abdication. These are a far cry from the scientific, logical, disciplined and professional process that we recommend, and they will end up costing you significant time, money, and heartache.

A large contingency is an alternative to good management. This is true in almost all aspects of human endeavor, especially business and property management. In fact, a large contingency is appropriate when your physical analysis is inaccurate, blurring the lines between expected costs and expensive surprises. So if you can’t develop managerial discipline and professionalism, then you should maintain a large contingency.

Most people don’t realize how important historical building information is to making great, informed, cost-effective decisions long-term. Owners with organized project, maintenance and repair documentation including plans, construction specifications, inspection reports, bids, contracts, inspection documentation, etc, are in a far better position to make smart decisions, since they know where they have been. With today’s technology, including virtually free electronic storage “in the cloud,” there are no more excuses. And guess what? PFCS has an online, cloud-based, password protected Client Access system to organize and store all your documents and make them easily available and searchable, indefinitely.

Why Lawyers Should Care…

What I told you is that a robust, analytical reserve study can be leveraged for a total cost of ownership (TCO) analysis for the period being studied (usually 30 years). Be sure to check back next week for our blog post on why lawyers should care about reserve funding and risk management!

Ready to Eliminate Surprises and Overfunding?

Pete Fowler Construction Services (PFCS) can help get you there. Our team of expert consultants specializes in creating real, practical solutions for owners, associations and managers. We help you make intelligent decisions by examining your property, diagnosing problems, specifying the right maintenance and repairs, and applying construction management discipline to your project (including bidding and writing contracts to protect the owners, performing quality control inspections, managing change orders and processing invoices). We provide actionable insight and expertise to right your project, and clear up any messes that others may have created along the way.

To learn more, visit our website or give us a call at our Southern California Office (949) 240-9971 or Portland Office (503) 660-8670.

THE RESERVE FUNDING SERIES

Part I: Getting a Grip on Reserve Funding Jan 8, 2014

Part II: Best Practices in Reserve Funding & Risk Mitigation Jan 27, 2014

Reserve Funding & Risk Mitigation: The Bottom Line Feb 13, 2014